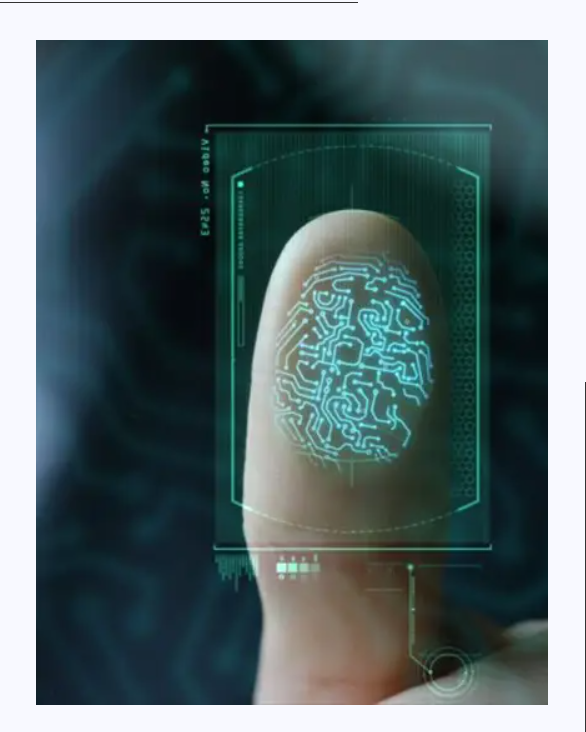

Enhance Digital Security with NFC Verification Services and Face Liveness Check

In today's fast-paced digital world, identity fraud is a growing concern. As more services shift online, the demand for secure and seamless identity verification solutions is higher than ever. Two powerful technologies addressing this need are NFC verification services and face liveness check—together offering unmatched protection against spoofing and unauthorized access.

What is NFC Verification?

NFC (Near Field Communication) verification is a modern identity verification method that uses the NFC chip embedded in passports, ID cards, and e-passports. When a user taps their NFC-enabled document against a smartphone or reader, encrypted data is instantly extracted and verified for authenticity.

NFC verification ensures:

-

Instant identity document authentication

-

Protection against forged documents

-

Seamless onboarding with minimal friction

With NFC verification, businesses can confirm the legitimacy of a document directly from the chip, eliminating the risk of counterfeit IDs.

Understanding Face Liveness Check

While face recognition is widely used, it’s vulnerable to spoofing through photos or videos. That’s where the face liveness check becomes crucial. This AI-powered technology determines whether the face presented is that of a live person in real time, not a printed photo or deepfake.

Benefits of face liveness detection include:

-

Strong defense against identity spoofing

-

Real-time biometric verification

-

Frictionless user experience

The face liveness check uses motion analysis, texture patterns, and response cues to ensure the person in front of the camera is physically present and alive.

Why Combining NFC and Face Liveness Matters

On their own, both technologies offer strong security. But when NFC verification and face liveness checks are combined, they deliver a robust multi-layered verification process. First, NFC confirms the ID’s authenticity. Then, the face liveness check ensures the person presenting the ID is its rightful owner.

This dual-layer security is ideal for:

-

Digital KYC (Know Your Customer) processes

-

Remote customer onboarding

-

Financial services, healthcare, and eGovernment platforms

Conclusion

As fraud tactics become more advanced, businesses must stay ahead with next-gen identity verification. By integrating NFC verification services with face liveness check, organizations can safeguard user data, reduce onboarding time, and maintain compliance—without sacrificing user convenience.

Stay secure, stay smart—embrace the future of digital identity verification.

- Consumer

- Purveyors Hedge Program

- Barn/ Flock Program

- Egg-Royaltist

- Bio-Security

- FlockTalk

- Dozens That Deliver Coopons TM